As the unpredictable world of cryptocurrencies continues to attract both seasoned investors and newcomers alike, the recent trends related to Bitcoin’s short-term holders have caught the attention of market analysts. Observing the dynamics of short-term holders and their profit or loss is crucial, as it provides valuable insights into the market’s sentiment and overall stability. Recent data shows that Bitcoin’s short-term holders are experiencing losses similar to those seen in August 2024. Understanding these patterns can inform our investment strategies and help anticipate future market movements.

This article aims to delve into the intricacies of Bitcoin’s short-term holdings, exploring the MVRV (Market Value to Realized Value) ratio and the implications of the STH (Short-Term Holder) Realized Price. We will analyze how these metrics intertwine with market sentiment and identify the key factors contributing to the current loss levels among short-term holders.

Understanding Short-Term Holders in Bitcoin

Short-term holders in Bitcoin are generally defined as those who have held their assets for less than 155 days. This group is particularly sensitive to market fluctuations, impacting the overall volatility of Bitcoin prices. When this demographic is showing significant losses, it can be a strong indicator of bearish market sentiment.

The importance of tracking short-term holders is often underscored by their behavioral tendencies; they tend to react quickly to market changes, leading to increased trading volume during dips and peaks. Recent studies have shown that over 60% of short-term holders are currently operating at a loss, mirroring patterns witnessed in past market corrections.

The Role of the MVRV Ratio

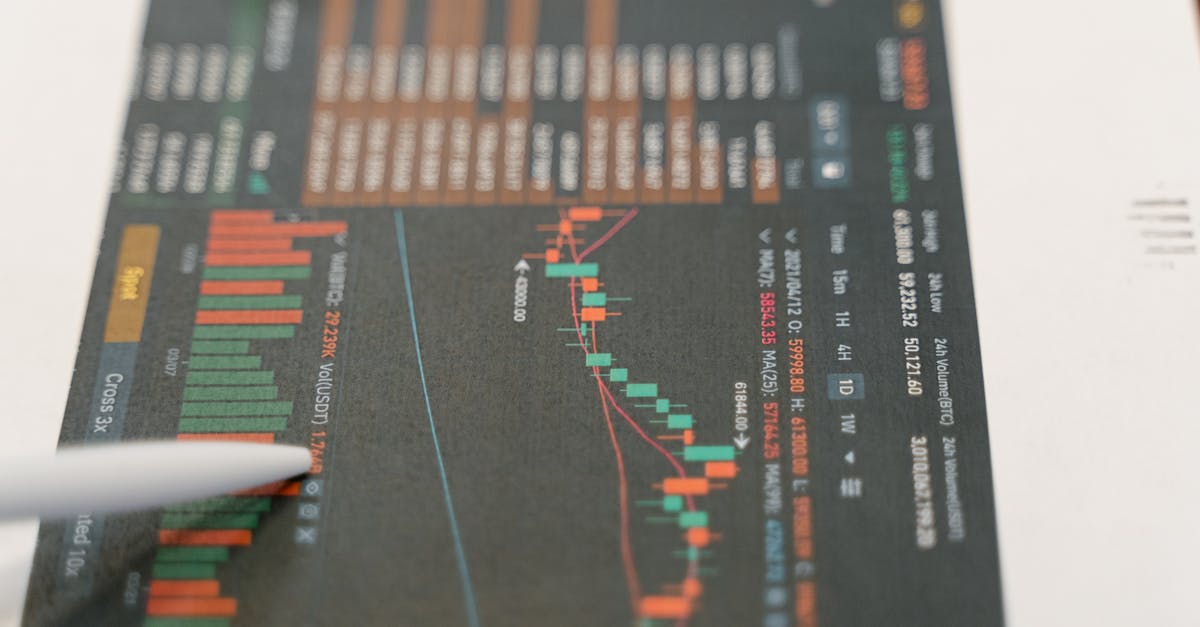

The MVRV ratio is a powerful tool used to assess the average profit or loss of all Bitcoin holders. By comparing the market value of Bitcoin to its realized value (the price at which coins last moved), investors can gain insights into market psychology.

A declining MVRV ratio signals that more holders are selling at a loss, which may further aggravate market sentiment. For example, a data point from Glassnode indicates that an MVRV of less than 1 suggests market participants are, on average, underwater on their investments.

Analyzing Short-Term Holder Realized Price

The STH Realized Price offers another perspective on the sentiment of short-term holders. This metric reflects the average cost basis for coins held by short-term holders, which can indicate the price point at which many of them would start to exit their positions.

As Bitcoin trades below the STH Realized Price, the pressure on these holders increases, often leading to further sell-offs. Tracking how this price changes over time provides essential insights for predicting future rallies or declines.

Current Market Implications

The current loss level among short-term holders signifies a turbulent phase for Bitcoin. As mentioned earlier, aligning losses with historical data can indicate potential price retraction in the short term.

Investors should exercise caution and consider these factors when making decisions. Various analysts advise against panic selling; historically, recovering from similar past downturns has often resulted in interesting buying opportunities for long-term holders.

Future Outlook for Short-Term Holders

Understanding the behaviors and triggers influencing short-term holders is crucial for future predictions. If the MVRV and STH Realized Price metrics stabilize, we may see a shift in sentiment and a potential recovery rally.

Investors should keep a keen eye on these indicators to navigate potential pitfalls and capitalize on market recovery. Resources like Glassnode provide continuous data monitoring that can help in this regard.

Conclusion

The current loss levels for short-term Bitcoin holders reflect a challenging landscape, mirroring trends seen in past market corrections. However, understanding metrics like the MVRV ratio and STH Realized Price can empower investors with the knowledge needed to make informed decisions.

As we move forward, it’s essential to keep track of market behaviors and adjust strategies accordingly. Investors can learn from history, using past cycles to inform future actions. With patience and a keen insight into the underlying metrics, both new and experienced investors can navigate through these tumultuous waters, aiming for long-term success.